BUYERS STEP BY STEP GUIDE FOR BUYERS

The Ultimate Home Buyer’s Roadmap: Your Step-by-Step Guide to Buying a Home

Buying a home is one of life’s biggest milestones — and while it can feel overwhelming, having a clear plan makes all

the difference. This roadmap walks you through every stage of the journey, from preparation to move-in day, so you

know exactly what to expect.

Step 1: Initial Planning & Financial Readiness

Check your credit score (aim for 620+ or higher for most loans)

Calculate your budget — how much home can you comfortably afford?

Review your monthly expenses and savings for down payment & closing costs

Gather key financial documents (W2s, pay stubs, tax returns, bank statements)

Research available mortgage programs (FHA, Conventional, VA, USDA, etc.)

Speak with a lender for pre-approval — know your price range before you shop

■ Tip: Pre-approval shows sellers you’re a serious buyer and gives you a competitive edge.

Step 2: Partner with a Realtor You Trust

Interview and select a trusted real estate professional

Discuss your home criteria, lifestyle needs, and must-have features

Set up a customized MLS home search

Review market trends and property values in your target area

■ Tip: A great agent will guide you through every step, negotiate on your behalf, and protect your interests.

Step 3: The Home Search

Tour homes (in-person or virtually)

Evaluate neighborhoods — schools, commute, amenities, and walkability

Compare property taxes, HOA fees, and local utilities

Take notes and photos during showings to keep track

■ Tip: Don’t rush! The right home should check your most important boxes and feel like the right fit.

Step 4: Making an Offer

Review recent comparable sales with your agent

Decide on an offer price and key terms (closing date, contingencies, etc.)

Submit your offer package (proof of funds, pre-approval letter, signed contract)

Be ready to negotiate counteroffers or multiple offers

■ Tip: In a competitive market, strong terms and flexibility can win over sellers.

Step 5: Attorney Review (New Jersey Requirement)

Your attorney reviews the contract and proposes changes if needed

Seller’s attorney responds with their edits

Once both parties agree, attorney review concludes and the deal is binding

■ Tip: Choose an experienced real estate attorney familiar with NJ laws.

Step 6: Home Inspection

Hire a licensed home inspector

Attend the inspection and take notes

Review inspection report with your agent and attorney

Request repairs, credits, or renegotiation if needed

■ Tip: This is your chance to learn about your home’s true condition — use it wisely.

Step 7: Mortgage Application & Appraisal

Submit full mortgage application and required documents

Lender orders an appraisal to confirm property value

Provide any additional info the lender requests promptly

Lock in your interest rate

■ Tip: Stay responsive during this stage — delays can push back closing.

Step 8: Title, Insurance & Final Mortgage Commitment

Order title search and title insurance

Obtain homeowner’s insurance policy

Review loan commitment letter (clear to close!)

Schedule your closing date

■ Tip: Confirm the final amount due at closing so there are no surprises.

Step 9: Final Walk-Through

Confirm all repairs (if any) have been completed

Test all systems — lights, water, appliances, HVAC

Check that nothing has been removed that shouldn’t be

Verify home is clean and ready for move-in

■ Tip: Bring your contract and inspection report to reference if needed.

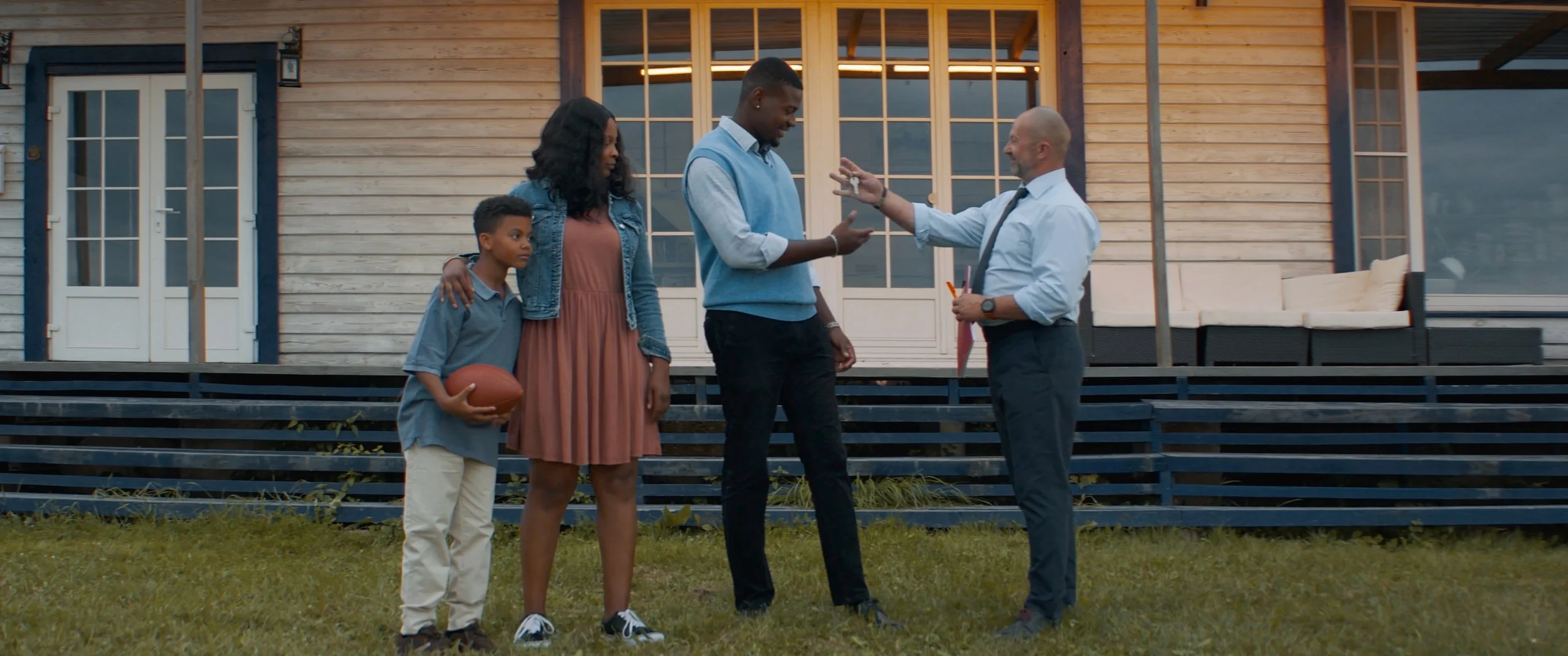

Step 10: Closing Day!

Review and sign closing documents

Pay closing costs and final down payment

Receive your keys and closing packet

Celebrate — you’re a homeowner! ■

■ Tip: Keep all documents and warranties in a safe place for future reference.

Step 11: After Closing

Set up utilities and change your address

Update driver’s license and voter registration

Meet your neighbors and learn about local community services

Schedule maintenance and keep up with property care

■ Tip: Owning a home is an investment — take care of it and it will take care of you.